You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Brighton sold

- Thread starter Admin

- Start date

Why did this company buy Brighton if it can't create much in the way of real estate? Are they just betting that the value is going to increase, with the buyback option as a worst-case scenario?

jamesdeluxe":h3c2q5k2 said:Why did this company buy Brighton if it can't create much in the way of real estate? Are they just betting that the value is going to increase, with the buyback option as a worst-case scenario?

In essence Boyne mortgaged the property. Look at those lease terms -- CNL Income Properties is buying the resort for $35M and getting at least $3M per year in lease revenues.

ChrisC

Well-known member

This transaction is complete BS.

$35M seems very low. I bet Brighton is cash cow - in a growing state like Utah, no snowmaking needed, SLC build-out, etc

What is going on here?

A long-term lease like this is the same as owning the resort of Brighton - especially accounting-wise. So Boyne is not changing anything.

The REIT - CNL - is most likely f-ed these days - looking for investments in an over inflated real estate market. Due to the disparity between rent/buy prices, it is great to become a rental landlord - especially if you can get the asset for a cheap price. And that's what they did.

So now Boyne has $35M to play with.

And you know where that is going? Other Boyne properties with a better economic future...unlike Brighton.

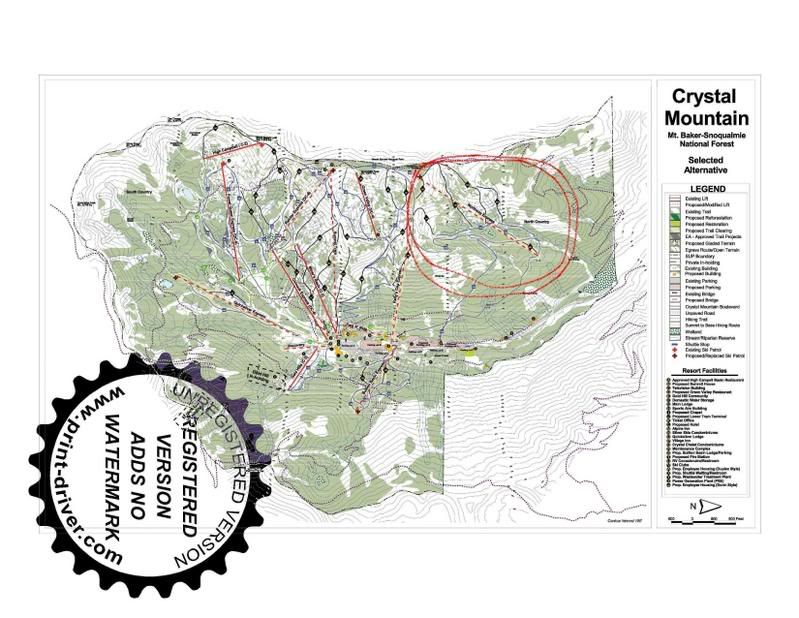

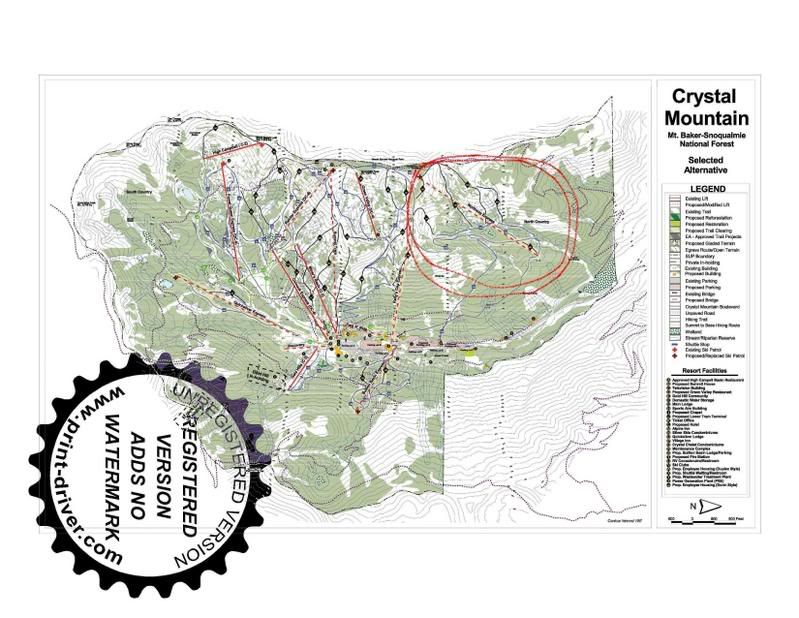

Crystal Mountain, WA and Big Sky, MT

Me likey master plan for Crystal...although goodbye North Country.

Me no likey stamps for free sw.

$35M seems very low. I bet Brighton is cash cow - in a growing state like Utah, no snowmaking needed, SLC build-out, etc

What is going on here?

A long-term lease like this is the same as owning the resort of Brighton - especially accounting-wise. So Boyne is not changing anything.

The REIT - CNL - is most likely f-ed these days - looking for investments in an over inflated real estate market. Due to the disparity between rent/buy prices, it is great to become a rental landlord - especially if you can get the asset for a cheap price. And that's what they did.

So now Boyne has $35M to play with.

And you know where that is going? Other Boyne properties with a better economic future...unlike Brighton.

Crystal Mountain, WA and Big Sky, MT

Me likey master plan for Crystal...although goodbye North Country.

Me no likey stamps for free sw.