You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

International Medical Insurance

- Thread starter Marc_C

- Start date

AMEX Travel Medical covers anything more than 150 miles from home with only exclusion for pre-existing conditions. It also includes emergency evacuation. We pay $109 every 6 months. Max coverage per incident is $100K.

I used credit card (Commonwealth Bank) travel insurance when going to Canada and USA for ski trips and I've found them reliable. I have claimed once for being 'snowed in' and once for a relatively minor medical claim.

For ski trips to Japan and Europe I use one of the specific insurers like -

www.nibtravelinsurance.com.au

as the credit card insurers in my experience do not provide cover for 'off piste' skiing.

www.nibtravelinsurance.com.au

as the credit card insurers in my experience do not provide cover for 'off piste' skiing.

Interestingly the premiums are more expensive to go to USA and Canada. I can only assume because of the high cost of medical care.

Is there no 'reciprocal' medical health care agreement between USA and Canada? Australia has that set up with a number of countries. Italy, New Zealand, UK, Slovenia and Sweden the only countries on the list that one would travel to for skiing.

EDIT - My question on the reciprocal medical agreements with other countries was a dumb one. USA doesn't have free healthcare for all it's own citizens so I guess there is no chance they'd provide healthcare for foreigners.

For ski trips to Japan and Europe I use one of the specific insurers like -

nib Travel Insurance | Cover for your holiday | Get a quote

Travelling soon? Consider nib travel insurance. Browse our range of travel insurance plans, international, domestic and annual multi trip ✈

Interestingly the premiums are more expensive to go to USA and Canada. I can only assume because of the high cost of medical care.

Is there no 'reciprocal' medical health care agreement between USA and Canada? Australia has that set up with a number of countries. Italy, New Zealand, UK, Slovenia and Sweden the only countries on the list that one would travel to for skiing.

EDIT - My question on the reciprocal medical agreements with other countries was a dumb one. USA doesn't have free healthcare for all it's own citizens so I guess there is no chance they'd provide healthcare for foreigners.

Last edited:

Is there no 'reciprocal' medical health care agreement between USA and Canada?

There's no free lunch here, mistah!USA doesn't have free healthcare for all its own citizens so I guess there is no chance they'd provide healthcare for foreigners.

On my recent trip to France, I noticed when buying day tickets at all of the ski areas I visited that cashiers proactively asked if I'd like to add the 3€credit card insurers in my experience do not provide cover for 'off piste' skiing

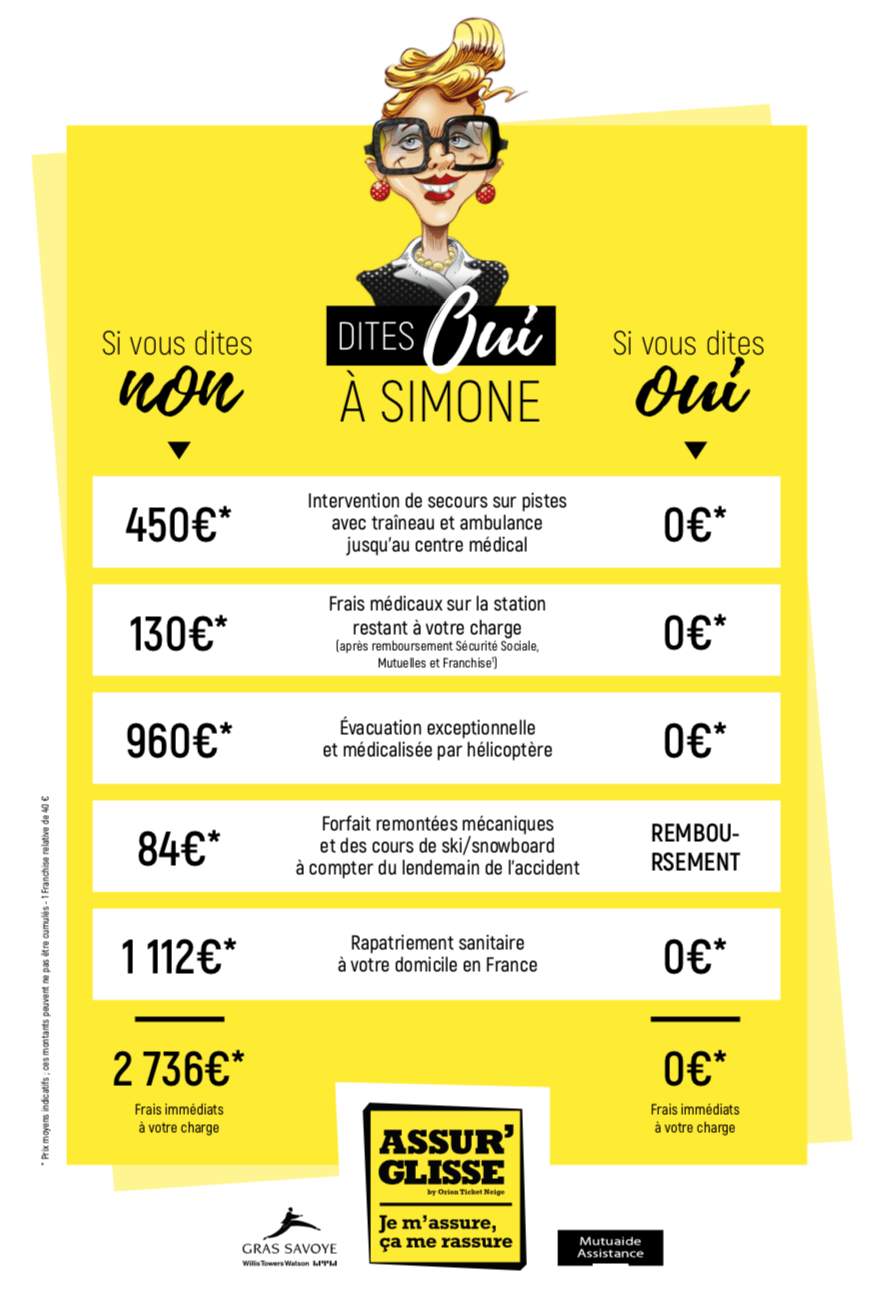

insurance fee to cover emergency evac from the mountain (as explained to me that's per ski area, not per day; thus, it's still 3€ if you buy a multiple-day pass for the same resort). Does anyone remember them doing that (asking if you'd like to buy it at the point of purchase) before? They've also created a campaign with a fictional character (see "Simone" below) to remind you about it.

They now put the costs of getting you off the mountain on a website if you don't have insurance (so you can't claim ignorance):

- 450€ via the meat wagon followed by an ambulance to the hospital along with 130€ for medical attention administered at the ski area

- 960€ via helicopter to the hospital (I thought it'd be more than that)

Last edited:

jasoncapecod

Well-known member

This is a interesting topic...I'm going to South Africa in a few weeks, do we need to look into insurance?

Prompted by @Marc_C's question, I dug out the extensive benefits guide to my United Airlines Mastercard -- which earns virtually all the miles that result in my FF awards -- and the $100K in travel accident insurance that comes along with the card. I've read it three times and the main "what's not covered" bullets (other than obvious ones like: while committing any illegal act, while incarcerated, self-inflicted injury, and declared and undeclared war) are: parachute jumping from an aircraft, a motor vehicle race or speed contest, and a professional sporting activity in which you receive a salary or prize money.

Tony, what else should I investigate to ensure that I'm properly covered during a ski trip?

Tony, what else should I investigate to ensure that I'm properly covered during a ski trip?

EMSC

Well-known member

Yes, that was an option even back in ~2010 time frame for me at various spots in France at least. I recall it being ~5-10EUR option at Chamonix area resorts for example.I noticed when buying day tickets at all of the ski areas I visited that cashiers proactively asked if I'd like to add the 3€

insurance fee to cover emergency evac from the mountain (as explained to me that's per ski area, not per day; thus, it's still 3€ if you buy a multiple-day pass for the same resort). Does anyone remember them doing that before?

As far back as I can remember, Euro ski areas have provided on-mountain rescue insurance for a fee, whereas it's included in North America lift tix. I hadn't bothered with it in recent years because I wasn't skiing at places like La Grave. In any case, asking customers at the window if they'd like it and reminding them on signage was something I'd never run across and a good idea IMO. I'm going to check with my credit card to make sure it's included.

For the record my comments we certainly not criticism - just an observation. There’s a fair argument that our ‘free lunch’ promotes ungratefulness and laziness.There's no free lunch here, mistah!

I always get the Carte Neige. It’s important to remember it covers evacuation but not the surgery to put pins and screws in your tibia. And if your policy doesn’t cover off piste insurance and the accident happened beyond the marked trails you won’t be covered for said surgery.On my recent trip to France, I noticed when buying day tickets at all of the ski areas I visited that cashiers proactively asked if I'd like to add the 3€

insurance fee to cover emergency evac from the mountain (as explained to me that's per ski area, not per day; thus, it's still 3€ if you buy a multiple-day pass for the same resort). Does anyone remember them doing that before? They're also putting it on signage -- see the "Simone" character on the left reminding you about it.

There is no way I’d go to SA without travel insurance.This is a interesting topic...I'm going to South Africa in a few weeks, do we need to look into insurance?

Sure, the surgery would be for your personal insurance to cover (hopefully).it covers evacuation but not the surgery to put pins and screws in your tibia.

I did not know that the United card provided $100K travel accident as part of the card. As noted before, we pay AMEX $109 every 6 months. While the United card provides medical treatment, does it cover medical evacuation (Simone's items 1 and 3)?

Our AMEX policy was accepted by Ice Axe and Quark for the 2011 ski mountaineering cruise, and I think that's a quite high bar. So yes, I would expect it to cover say, La Grave. I do not recall whether I had the AMEX policy yet when I went to South Africa in 2002.

Our AMEX policy was accepted by Ice Axe and Quark for the 2011 ski mountaineering cruise, and I think that's a quite high bar. So yes, I would expect it to cover say, La Grave. I do not recall whether I had the AMEX policy yet when I went to South Africa in 2002.

EMSC

Well-known member

Be careful with reading cards. I believe there are at least 3 rather different levels of United cards currently for example and each with different levels of benefits.I did not know that the United card provided $100K travel accident as part of the card.

Also, Travel CC cards break up coverages into a fair number of highly specific categories. Sometimes "$100K accident insurance" means if you die in a common carrier plane, bus, train etc... type crash your relatives get paid - not medical insurance payments for recreation activity accidents for example. General point is: read the fine print on any of them for your specific card, don't just assume based on a general heading/statement as you glance through the benefits listed.

I'm going to get in writing what the card covers vis-à-vis recreational sports. Worst-case scenario: I continue to pay Simone €3 per ski area.General point is: read the fine print on any of them for your specific card, don't just assume based on a general heading/statement as you glance through the benefits listed.

After a maddening 30-minute telephone roundabout trying to speak with the appropriate rep at United Visa benefit services, he said that my card does not include emergency evac so there's my answer and @EMSC was correct.

I'll thus continue to pay the 3€ per day in Europe or if I spend at least 15 days there, I'll get the season-long option for 45€. Given that you normally save well more than 45€ for a daily lift ticket to a comparable stateside ski area, it's a deal and @Sbooker (because you mentioned it above), see below -- it covers offpiste as well.

GUARANTEES AND RESCUE EVACUATION PRICING

And here she is, Simone! In the jingle, she considers herself a hotshot but hit a snow snake, broke her leg and nose, was transported out in a helicopter, and had to pay for the costs because she wasn't covered ("what a mess").

I'll thus continue to pay the 3€ per day in Europe or if I spend at least 15 days there, I'll get the season-long option for 45€. Given that you normally save well more than 45€ for a daily lift ticket to a comparable stateside ski area, it's a deal and @Sbooker (because you mentioned it above), see below -- it covers offpiste as well.

GUARANTEES AND RESCUE EVACUATION PRICING

Search and rescue costs on and off the ski runs | X | X | X | X |

| Refund of your unused ski-lift packages and skiing lessons in case of accident | X | X | X | |

| Additional medical costs incurred at the resort following a skiing accident | X | X | X | X |

| Repatriation in the case of a serious accident | X | X | X | X |

| Refund of insured packages for your family in the event of repatriation of an insured member of your family for health reasons | X | X | X | X |

| Public-liability insurance and legal expenses insurance | X |

And here she is, Simone! In the jingle, she considers herself a hotshot but hit a snow snake, broke her leg and nose, was transported out in a helicopter, and had to pay for the costs because she wasn't covered ("what a mess").